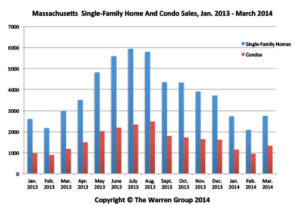

BOSTON, April 23, 2014 – Sales of single-family homes in Massachusetts dipped in March, marking the fourth time sales have decreased in five months, according to a new report by The Warren Group, publisher of Banker & Tradesman.

Single-family home sales dropped 7.8 percent to 2,749 in March, down from 2,980 in March 2013. Home sales in the first quarter were down 2.4 percent to 7,557 from 7,745 in last year’s first quarter.

The median price for single-family homes sold in March rose 8.6 percent to $315,000 from $290,000 a year earlier. It was the eighteenth consecutive month that monthly home prices have increased year-over-year. The first quarter median selling price was $305,000, a 7.0 percent increase from $285,000 in the first quarter of 2013.

“The low inventory of single-family homes in the market is the primary cause of the decreasing sales activity,” said Timothy M. Warren Jr., CEO of The Warren Group. “Motivated buyers, however, are eagerly bidding for the limited supply which accounts for the increasing sales prices. People want to buy homes before prices and interest rates rise further.”

“The low inventory of single-family homes in the market is the primary cause of the decreasing sales activity,” said Timothy M. Warren Jr., CEO of The Warren Group. “Motivated buyers, however, are eagerly bidding for the limited supply which accounts for the increasing sales prices. People want to buy homes before prices and interest rates rise further.”

Condominium sales increased statewide by 12.6 percent in March 2014 with 1,328 sales up from 1,179 in March of last year. A total of 3,420 condo sales transactions were recorded in the first three months of the year, a 12.2 percent increase from the 3,049 transactions a year earlier.

The median price for condos sold in March was $291,500, up more than 10.4 percent from $264,000 in March 2013. The first quarter median condo price was also up more than 15.7 percent to $290,000 from $250,500 during the prior year’s first quarter.

“As we see from the sales numbers, condos continue to be an attractive option for first-time home buyers or empty nesters,” said Warren. “With a tight apartment market and rising rents, condominiums are hot right now.”

The Warren Group also tracked the number of mortgage loans (purchase and non-purchase up to $750,000) on single-family properties in March 2014. 2,324 purchase loans were recorded this month, down 11.0 percent from the 2,611 purchase loans taken out last year at this time. In the first quarter of this year, purchase loans were down by 4.8 percent to 6,348 loans compared with 6,665 in the first quarter of last year.

Non-purchase loans for single-family homes, which include home equity loans and lines of credit, refinances, reverse mortgages, and new construction loans up to $750,000, were down by 59.3 percent in March 2014. 6,710 non-purchase loans were recorded in March compared with 16, 469 recorded at the same time last year. Non-purchase loans for the first quarter of this year were also down 65.0 percent to 18,419 transactions compared with 52,474 recorded in the first quarter of last year.

Recent Comments