A significant decline in Massachusetts foreclosures during the month of March indicates the foreclosure crisis is over, according to an article in Monday’s issue of Banker & Tradesman.

A significant decline in Massachusetts foreclosures during the month of March indicates the foreclosure crisis is over, according to an article in Monday’s issue of Banker & Tradesman.

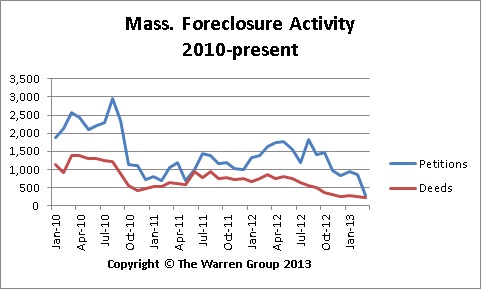

Lenders filed 284 petitions to foreclose in March, an 82 percent decrease from 1,621 in March 2012, according to data from The Warren Group, publisher of Banker & Tradesman. A total of 2,080 petitions to foreclose have been filed in Massachusetts during the first quarter, a 52 percent decrease from 4,348 in the first quarter of last year. Petitions to foreclose represent the first step in the foreclosure process in Massachusetts.

“Overall, we’re seeing foreclosures drop all over the country, but Massachusetts is exceptional in its reduction. The Mortgage Bankers Association reports that we rank 48th in foreclosures started in the first quarter of 2013,” said The Warren Group CEO Timothy M. Warren Jr. “Foreclosure prevention efforts combined with a booming real estate market are leading to fewer foreclosures.”

Foreclosure deeds, which represent finished foreclosures, also posted a sharp decrease in March. Foreclosure deeds dropped more than 74 percent to 227 in March, down from 899 in March 2012. Foreclosure deeds totaled 716 in the first quarter of 2013, a near 71 percent decrease from 2,465 in the first quarter of 2012.

The number of auction announcements tracked by The Warren Group fell in March compared to a year earlier. There were 398 auction announcements in March, a 67 percent decrease from 1,214 announcements during the same month last year. In the first three months of the year, there were 1,102 auction announcements, down more than 73 percent from 4,174 during the same period in 2012.

Recent Comments