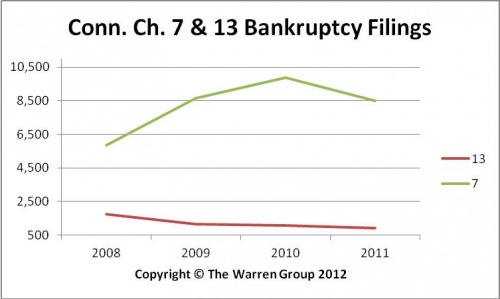

BOSTON, February 9, 2012 – Personal bankruptcy filings in Connecticut dropped by 14 percent to 8,518 in 2011, down from 9,887 in 2010, according to a new report from The Warren Group, publisher of The Commercial Record.

BOSTON, February 9, 2012 – Personal bankruptcy filings in Connecticut dropped by 14 percent to 8,518 in 2011, down from 9,887 in 2010, according to a new report from The Warren Group, publisher of The Commercial Record.

Chapter 7 is the most common option for individuals who are seeking relief from their debts, and accounted for 89 percent of bankruptcy filings in Connecticut in 2011.

In the fourth quarter, 1,795 filers statewide sought bankruptcy protection under Chapter 7, compared to 2,348 in the fourth quarter of 2010. The fourth quarter saw the slowest quarterly bankruptcy pace of 2011 – it represented 21 percent of the annual total. In the second quarter, bankruptcies peaked for the year and represented 30 percent of the annual total.

“I’m encouraged by the drop in bankruptcy filings, it indicates that consumers are more optimistic about their ability to pay off debt and clean up their financial situations,” said The Warren Group CEO Timothy M. Warren Jr. “The decrease in bankruptcy filings is running parallel with lower unemployment rates in Connecticut. Unfortunately, I haven’t seen a big enough improvement in the employment picture to confidently say the economy has completely turned the corner.”

People filing under Chapter 7 bankruptcy can eliminate most debt after non-exempt assets are used to pay off creditors. In contrast, Chapter 13 requires debtors to arrange for a three- or five-year debt-repayment plan.

Chapter 13 bankruptcy filings decreased 14 percent to 934 in 2011, from 1,087 in 2010.

Chapter 11 filings, which are used for business bankruptcies and restructuring, also declined slightly last year. Filings dropped 9 percent to 119, down from 131 in 2010.

A total of 9,571 filers statewide sought protection under Chapter 7, Chapter 13 and Chapter 11 of the U.S. bankruptcy code in 2011, down from 11,105 in 2010.

Bankruptcy Definitions:

Chapter 7 bankruptcy, sometimes called a straight bankruptcy, is a liquidation proceeding. The debtor turns over all non-exempt property to the bankruptcy trustee who then converts it to cash for distribution to the creditors. The debtor receives a discharge of all dischargeable debts usually within four months. In the vast majority of cases the debtor has no assets that he would lose, so Chapter 7 will give that person a relatively quick “fresh start.”

Chapter 13 bankruptcy is also known as a reorganization bankruptcy. Chapter 13 bankruptcy is filed by individuals who want to pay off their debts over a period of three to five years. This type of bankruptcy appeals to individuals who have non-exempt property that they want to keep. It is also only an option for individuals who have predictable income and whose income is sufficient to pay their reasonable expenses with some amount left over to pay off their debts.

Chapter 11 bankruptcy is typically used for business bankruptcies and restructuring. It is not commonly used by individual consumers since it is far more complex and expensive to pursue. It allows businesses to reorganize themselves, giving them an opportunity to restructure debt and get out from under certain burdensome leases and contracts. Typically a business is allowed to continue to operate while it is in Chapter 11, although it does so under the supervision of the Bankruptcy Court and its appointees.

Recent Comments