Low Rates, Stimulated Home Sales Boost Activity

Low Rates, Stimulated Home Sales Boost Activity

BOSTON, March 28, 2013 – The recovery year for the local housing market is evident in recent statistics – showing 2012 mortgage activity in New England at the highest level in five years, according to new data from The Warren Group’s Mortgage MarketShare Module.

While Massachusetts, Connecticut and Rhode Island all recorded strong activity in 2012, mortgage activity in Massachusetts was the strongest.

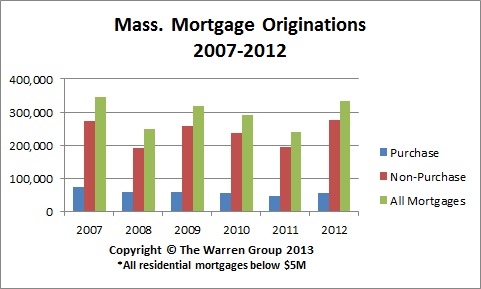

Total residential mortgage activity in the Bay State rose almost 38 percent statewide – increasing to 332,582 from 241,490 in 2011. Purchase mortgages spiked more than 25 percent to 57,324 from 45,824. Nonpurchase, or refinance mortgages rose almost 41 percent to 275,258 from 195,666 in all of 2011.

Last year marks the best year on record since 2007, when 346,655 total mortgages were originated in Massachusetts.

“Single-family home sales have increased in 13 of the last 14 months, a sure sign the housing market in recovery mode,” said Marie Wentling, director of product strategy at The Warren Group. “In addition to the spike in mortgages used to purchase homes, we saw a strong increase in refinance mortgages, partially credited to low rates and government assistance programs.”

Almost 83 percent of total mortgages in 2012 were refinances, compared to 81 percent in 2011. Nationally, the refinance share of applications was about 82 percent at the end of 2012, according to the Mortgage Bankers Association.

In Connecticut, all mortgage activity rose more than 26 percent in 2012. A total of 141,759 mortgages have been originated, up from 111,850 in 2011. This marks the most volume since 2007, when there were 192,278 mortgages originated. Purchase mortgages rose 13.5 percent to 24,757 from 21,808 in the prior year. In all of 2012, refinance mortgages increased 30 percent to 117,002, compared to 90,042 in 2011.

Rhode Island mortgage activity also improved drastically in 2012, marking the best year since 2009. A total of 42,680 mortgages were originated last year, up from 32,992 in the prior year. The total from 2009 barely beat this number, recording 42,745 total mortgages. Non purchase mortgages rose to 35,333 from 26,570 in all of 2011. Purchases mortgages increased more than 14 percent to 7,347, up from 6,422 during the same period last year.

Recent Comments