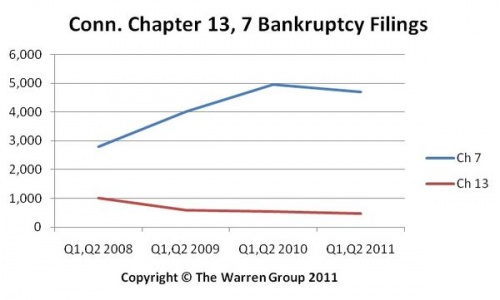

BOSTON, August 11, 2011 – Personal bankruptcy filings in Connecticut dropped 5 percent to 4,710 in the first half of the year, down from 4,968 during the same period a year ago, according to a new report from The Warren Group, publisher of The Commercial Record.

BOSTON, August 11, 2011 – Personal bankruptcy filings in Connecticut dropped 5 percent to 4,710 in the first half of the year, down from 4,968 during the same period a year ago, according to a new report from The Warren Group, publisher of The Commercial Record.

Chapter 7 is the most common option for individuals who are seeking relief from their debts, and accounted for nearly 90 percent of bankruptcy filings in Connecticut in the first half of this year.

During the second quarter, personal bankruptcy filings in Connecticut dropped more than 4 percent to 2,562, a slight drop from 2,674 during the same period in 2010.

“The fact that bankruptcies are holding steady, and even slightly decreasing from the same time a year ago is a good sign,” said Vincent Valvo, group publisher and editor-in-chief of The Commercial Record. “However, employment numbers have to improve before we can confidently say consumers are paying off debt and fewer are resorting to bankruptcy.”

People filing under Chapter 7 bankruptcy can eliminate most debt after non-exempt assets are used to pay off creditors. In contrast, Chapter 13 requires debtors to arrange for a three- or five-year debt-repayment plan.

Year-to-date Chapter 13 filings also decreased, falling 13 percent to 481, from 551 filings during the same period in 2010. Chapter 13 bankruptcy filings dropped 5.5 percent to 246 in the second quarter, down from 291 during the same period in 2010.

Chapter 11 filings, which are used for business bankruptcies and restructuring, are also down compared to the same time a year ago. Filings for the first six months of the year declined 23 percent – dropping to 57 from 74 during the same period in 2010. Second quarter filings dropped 30 percent to 23, down from 33 in the second quarter 2010.

A total of 5,248 filers statewide sought protection under Chapter 7, Chapter 13 and Chapter 11 of the U.S. bankruptcy code in the first two quarters of the year, down 6 percent from 5,593 during the same period in 2010.

Recent Comments