BOSTON, April 20, 2011 – Foreclosure activity in Massachusetts dropped significantly during the month of March, according to the latest report by The Warren Group, publisher of Banker & Tradesman. The number of foreclosures initiated by lenders plummeted almost 60 percent from a year earlier.

BOSTON, April 20, 2011 – Foreclosure activity in Massachusetts dropped significantly during the month of March, according to the latest report by The Warren Group, publisher of Banker & Tradesman. The number of foreclosures initiated by lenders plummeted almost 60 percent from a year earlier.

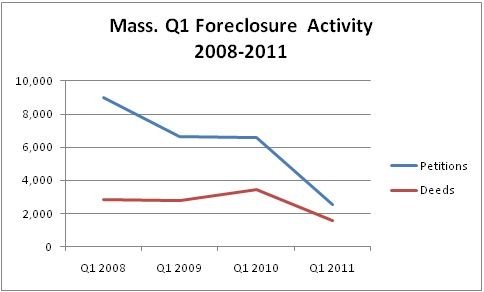

Lenders filed 1,048 petitions to foreclose in March, a 59.4 percent decrease from 2,581 in March 2010. A total of 2,535 petitions to foreclose have been filed in Massachusetts during the first quarter, a 61.5 percent decrease from 6,577 in the first quarter of last year. Petitions to foreclose represent the first step in the foreclosure process in Massachusetts.

“Another month of declining foreclosures is a sign that lenders have adopted a ‘go-slow’ approach to foreclosures,” said The Warren Group CEO Timothy M. Warren Jr. “We haven’t seen a drastic improvement in the housing market to signal the foreclosure crisis is over. There are likely more foreclosures in the pipeline, which will come to the surface in coming months.”

Foreclosure deeds, which represent finished foreclosures, also posted a sharp decrease in March. Foreclosure deeds declined 60.3 percent to 552 in March, down from 1,391 in March 2010. Foreclosure deeds totaled 1,593 in the first quarter of 2011, a 53.8 percent drop from 3,449 in the first quarter of 2010.

Foreclosure activity declined in every county in the state in March, with the exception of Nantucket County. Last month, there were seven auction announcements in Nantucket County, up from two in March 2010. Foreclosure deeds also increased to two completed foreclosures, up from one during March 2010.

The number of auction announcements tracked by The Warren Group fell in March compared to a year earlier. There were 1,172 auction announcements in March, a 62 percent decrease from 3,094 announcements during the same month last year.

Recent Comments